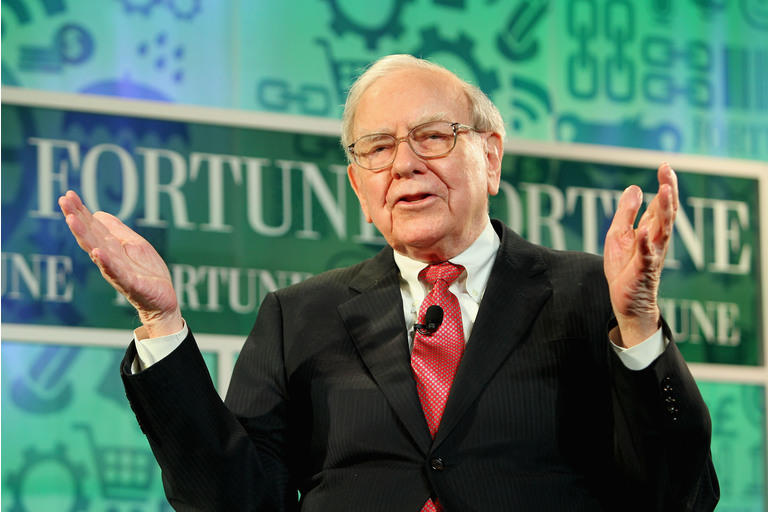

Warren Buffett Buys REITs Instead Of Real Estate, Here’s Why

Warren Buffett is one particular of the incredibly several investors to have managed to compound returns at a 20% yearly ordinary for more than 50 yrs.

Any individual can thrive over a 5-10 yr time period, but the genuine examination is whether or not you can maintain heading for ten years immediately after decade, and Warren Buffett’s Berkshire Hathaway (BRK.A) (BRK.B) is just one of the rare exceptions to have attained that:

| Berkshire Hathaway | S&P 500 (SPY) | |

| Compounded Once-a-year – 1964-2020 | 20.% | 10.2% |

| General Acquire – 1965-2020 | 2,810,526% | 23,454% |

So, when he talks, we pay attention.

In modern write-up, we appear closer at his tactic to serious estate investing. Around the a long time, he has frequently mentioned why he hardly ever purchases genuine estate, but extra just lately, he has manufactured big investments in the REIT sector (VNQ).

Below we highlight five factors why Warren Buffett favors REITs in excess of non-public residence investments:

Reason #1: No Competitive Advantage

In a shareholder conference many years back, Warren Buffett points out that they are not outfitted to compete with traders who focus in real estate investing.

The interesting detail below is that back then Warren Buffett already experienced invested thousands and thousands into serious estate, had sizeable means via Berkshire, and Charlie had manufactured his first fortune in true estate.

Even then, they felt that they could not contend with REITs and other LPs that specialized in actual estate investing and experienced an informational edge more than them.

Right here you should talk to by yourself: If Warren and Charlie simply cannot contend in the genuine estate space, can you?

A lot of unique buyers feel that right after viewing a few YouTube movies and purchasing a real estate investing course from an on the web guru, they’re perfectly well prepared to become genuine estate buyers.

In reality, most traders are overconfident and overestimate their abilities. Warren Buffett is very real looking about his limits and understands that except if you are 100% focused on authentic estate, you happen to be unlikely to accomplish fantastic benefits investing in it.

Reason #2: Absence of Mispricing

Relatively associated to purpose #1, if you are not fully focused to actual estate, you are unlikely to find mispriced possibilities.

Warren Buffett explains that mispricings in real estate are uncommon. The market is comparatively successful at pricing danger because most investors are extensive-expression oriented.

On the other hand, mispricings are much more frequent in the stock marketplace simply because most buyers are short-term-oriented and swift to panic when they see their inventory decline in value.

Warren believes that if you are an active investor, you might be much more probable to locate better deals in the stock industry, including REITs, than in private authentic estate.

That’s what he claimed a long time back and it is effectively reflected in modern marketplace.

Appropriate now, housing is red sizzling, and industrial real estate is advertising at historically minimal cap premiums. The rates mirror the ultra-lower curiosity amount ecosystem that we are living in.

Even then, the REIT current market is now severely mispriced. Lots of REITs, which includes blue-chip names like W.P. Carey (WPC), Realty Earnings (O), and National Retail (NNN) are down by 20-30% even as their fundamental houses are additional valuable than ever in advance of.

Which is a better option.

Cause #3: Corporate Tax Downside

Berkshire Hathaway is structured as a corporation and it’s liable to company taxes.

Charlie and Warren demonstrate that this puts them at a significant downside relative to REITs, which are exempt from company taxes.

If you receive a 6% produce on a property, the REIT is left with 6%, but Berkshire is still left with a lower profit thanks to taxes.

Even then, Berkshire has made REIT investments, which are more tax productive for the reason that REITs only pay back out 50%-70% of their dollars flow in dividends, and the rest is retained at the REIT stage and not taxed. In addition, REITs have a higher expansion/appreciation ingredient than personal serious estate, which benefits in decreased company taxes.

Reason #4: Administration And Scalability

In an job interview through the excellent money crisis, Warren Buffett explains that if he experienced a way to competently control actual estate, he would load up on solitary-relatives residences.

A whole lot of traders make the oversight of assuming that real estate is a passive financial investment when in reality it can be administration intense.

You are working with the dreaded 3 Ts: Tenants, bathrooms, and trash.

Could Warren Buffett retain the services of a house management company? Positive, he could. In actuality, he would get a much better offer than you or me if he did that.

Nevertheless, the challenge with assets management providers is that their charges eat into your profitability, but even much more importantly, their pursuits are not aligned with yours. Getting a assets and handing the keys to a property manager is the equal of obtaining an externally-managed REIT, which we all know, is hardly ever a superior notion owing to conflicts of interest.

With conventional REITs, Warren Buffett gets specialist management that is nicely aligned with shareholders and enjoys major economies of scale.

You also can very easily deploy cash in a handful of clicks of a mouse, which makes it quick to scale your investments about time.

Purpose #5: Chances are in REITs Currently

Warren Buffett is a benefit investor.

He wants to acquire high-high-quality assets at a low cost to fair value.

But as observed before, the non-public serious estate market place is at this time crimson very hot. With the exception of a couple of challenged sectors (office environment, malls, etc.), you’re unlikely to obtain discounted opportunities. The demand for private authentic estate is larger than ever ahead of because of to the extremely-small interest costs.

Even then, several REITs are now priced at traditionally lower valuations, and not incredibly, that’s what Warren is shopping for. Underneath we spotlight one particular of his most loved REITs:

Retailer Capital

Berkshire Hathaway initial purchased shares of Keep Capital (STOR) again in 2017, and a short while ago, they doubled down.

As a outcome, they now personal nearly 10% of the fairness:

In accordance to an interview of Chris Volk, CEO of Keep Money, it’s Warren Buffett that was driving this financial commitment. You can skip to the 8:55 mark to discover much more about Warren Buffett’s expenditure in Keep:

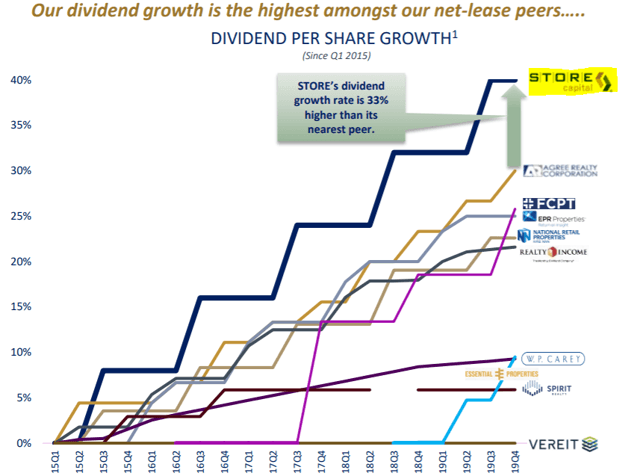

What is so exclusive about Shop Funds?

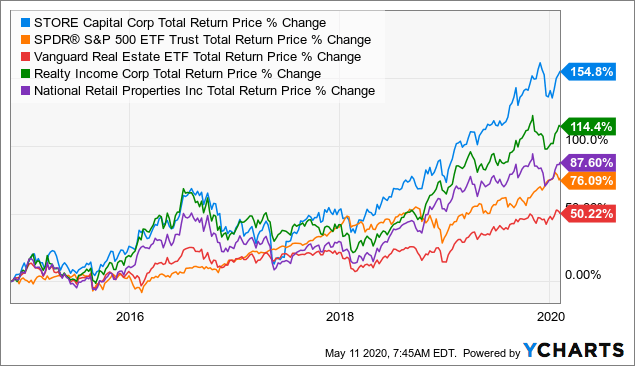

In shorter, STOR has a distinctive method that generates higher returns with reduce risk than what Berkshire could attain on its own. We go over this tactic in depth in a separate post so we will never go into the particulars right here, but its method has continually led to substantial outperformance relative to its near friends, and this is very likely to carry on significantly into the upcoming:

Even then, STOR has been priced at an exceptionally minimal valuation around the past 12 months. It can be however ~15% lower than prior to the pandemic, and that is in spite of climbing its dividend by 3% in 2020 and guiding for document-substantial funds movement in 2022.

You simply just are not able to discover this type of prospect in the private genuine estate market place and that is why Warren Buffett favors REIT investments.

Nowadays, there are ~25 very similar REIT prospects in which we are investing at Substantial Produce Landlord.